How Financial Services Can Leverage Rapid eLearning Solutions

The financial services sector is highly dynamic, characterized by continuous regulatory changes, shifting market dynamics, and the need for employees to acquire new skills and knowledge. In such an environment, keeping the workforce up to date is crucial for staying competitive, compliant, and maintaining a high level of customer trust. This blog aims to explore how the financial services industry can harness the power of rapid eLearning solutions to address its unique challenges. It will delve into the specific needs of this sector, the benefits of adopting rapid eLearning, and practical steps for implementation.

Financial Services Can Effectively Leverage Rapid eLearning Solutions!

Here’s how you can implement it -

- Identify training needs

- Choosing the right tools and platforms

- Content development

- Deployment and delivery

- Monitoring and assessment

The Need for Rapid eLearning in Financial Services

1. Rapid Changes in the Financial Industry

The financial industry experiences rapid changes in market trends, economic conditions, and customer preferences. To remain competitive, financial institutions must ensure that their workforce is constantly informed about these shifts. Government regulations and compliance requirements in the financial sector frequently evolve. Financial organizations need to adapt to these changes quickly to avoid legal and financial repercussions.

2. Employee Training Challenges

Financial institutions are subject to numerous regulations, and employees must undergo regular compliance training to ensure adherence. Rapid eLearning can streamline this process, making it easier to update and track compliance training. In addition to compliance, financial professionals need ongoing training to develop skills relevant to their roles. Rapid eLearning can provide flexible and targeted solutions for skill enhancement.

→ Download eBook Now: Rapid eLearning and the 4 Rs

3. Traditional Learning vs. Rapid eLearning

Traditional learning approaches in the financial sector are often slow, expensive, and rigid. Traditional methods may involve in-person seminars or lengthy development cycles for eLearning modules. Rapid eLearning offers a cost-effective and agile alternative, allowing organizations to respond quickly to emerging needs and ensure that employees receive up-to-date training efficiently. Watch this short video to understand why you should invest in rapid eLearning.

Benefits of Rapid eLearning Solutions for Financial Services

A. Speed and Agility

Rapid eLearning enables organizations to create training modules and materials in a fraction of the time it takes using traditional methods. This agility is essential when addressing urgent training needs. When financial regulations or market conditions change, rapid eLearning makes it easy to update training materials swiftly and distribute these updates to the workforce, ensuring everyone is on the same page.

B. Improved Learning Outcomes

Rapid eLearning solutions support the creation of engaging, interactive, and multimedia-rich training materials. This not only enhances learner engagement but also improves knowledge retention. With rapid eLearning, financial institutions can tailor training to individual employee needs, ensuring that everyone receives the most relevant and effective instruction. This personalization boosts learning outcomes and overall job performance.

Implementing Rapid eLearning in Financial Services

1. Identify Training Needs

- Compliance: Compliance training is a critical aspect of financial services, and rapid eLearning can help identify and address compliance gaps efficiently. It enables organizations to track and document employee training, ensuring all regulatory requirements are met.

- Product knowledge: Financial products and services are continually evolving. Rapid eLearning can help employees stay updated with the latest product information, improving their ability to serve clients effectively.

- Soft skills: Effective communication, customer service, and problem-solving skills are vital in the financial sector. Rapid eLearning can be used to develop these soft skills, enhancing employee performance.

2. Choose the Right Tools and Platforms

- Learning Management Systems (LMS): Selecting the appropriate LMS is crucial. A well-designed LMS can centralize training content, track progress, and provide analytics to measure the effectiveness of training programs. Here are a few popular LMS platforms to choose from -

- eLearning Authoring Tools: Utilizing user-friendly eLearning authoring tools helps streamline the creation of eLearning content. These tools allow subject matter experts to develop content without requiring extensive technical expertise.

3. Content Development

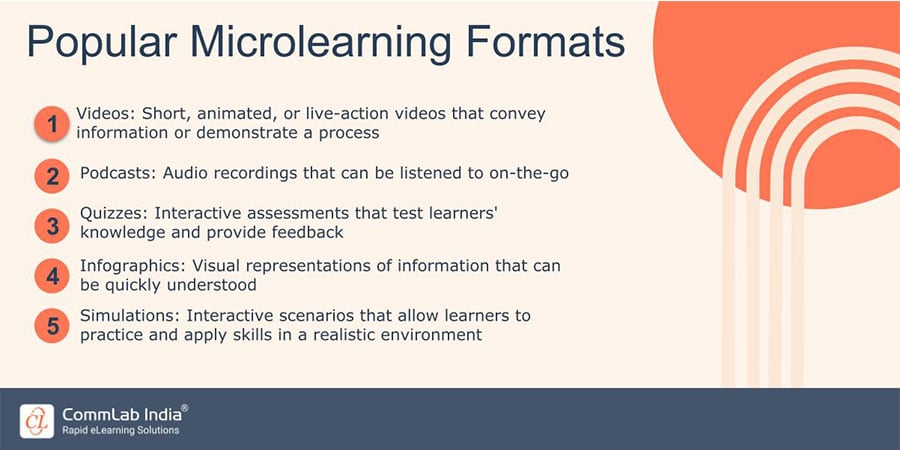

- Creating engaging content: Rapid eLearning solutions support the creation of interactive, multimedia-rich content that keeps learners engaged. This can include videos, quizzes, simulations, and gamified elements.

- Interactive modules: Leveraging interactivity in modules can help mimic real-world scenarios that financial professionals may encounter, enhancing their decision-making skills and practical knowledge.

4. Deployment and Delivery

- Accessibility and ease of use: Ensure that eLearning content is accessible across various devices, including mobile devices and desktops, making it convenient for employees to access training materials when and where they need them.

- User-friendly interfaces: User-friendly platforms and interfaces enhance the overall learning experience, making it easier for employees to navigate through the content.

5. Monitoring and Assessment

- Tracking progress: Implement tracking and reporting features to monitor individual and team progress. This data can help organizations identify areas that may require additional training.

- Assessing learning outcomes: Regular assessments and quizzes embedded within eLearning modules allow organizations to measure the effectiveness of training and make data-driven improvements.

Future Trends in Rapid eLearning for Financial Services

1. Artificial Intelligence and Machine Learning in eLearning

AI and machine learning will play a significant role in the future of eLearning in financial services. These technologies can provide personalized learning experiences by analyzing the strengths and weaknesses of individual learners. They can also offer intelligent recommendations for additional training modules based on an employee's performance and career goals.

2. Microlearning and On-Demand Training

Microlearning, which involves delivering content in small, bite-sized modules, is gaining popularity. In the financial sector, this approach can be particularly effective for quick updates on regulatory changes, product information, or specific skills. On-demand training allows employees to access training materials whenever they need them, increasing flexibility and adaptability.

3. Gamification and Immersive Learning Experiences

Gamification techniques, such as leaderboards, badges, and point systems, can make training more engaging and enjoyable for financial professionals. Additionally, immersive learning experiences, including virtual reality (VR) and augmented reality (AR) simulations, can provide a realistic environment for training, especially for roles involving complex financial operations or customer interactions.

Wrapping Up!

Rapid eLearning solutions provide organizations with a competitive edge by offering agility, cost-effectiveness, and improved learning outcomes. They help address the unique challenges in the financial sector, such as compliance and product knowledge training and pave the way for more effective skill development. While we are talking about rapid eLearning, here is an insightful eBook to help you understand more about rapid eLearning and its 4 Crucial Rs - Redesign, Record, Rebuild, and Republish. Check it out now for free!

![Key Features of Rapid eLearning [Infographic]](https://blog.commlabindia.com/hubfs/blogs/rapid-elearning-key-features-infographic.jpg)