Empowering Your Wallet: Embrace eLearning for Financial Education[Infographic]

![Empowering Your Wallet: Embrace eLearning for Financial Education[Infographic] Empowering Your Wallet: Embrace eLearning for Financial Education[Infographic]](https://blog.commlabindia.com/hubfs/blogs/Empowering-Your-Wallet-Embrace-eLearning-for-Financial-Education%5BInfographic.jpg)

Traditional methods of financial education, such as in-person seminars or workshops, can be limited by factors like time constraints and geographical limitations. However, with the advent of eLearning, individuals can now access comprehensive financial education at their own convenience. eLearning platforms offer a wide range of interactive resources and tools that make learning engaging and effective. In this blog post, we will delve into the advantages of eLearning for financial education and explore the flexibility and accessibility of eLearning.

Understanding the Need for Financial Education

The importance of financial education cannot be overstated in today's complex economic landscape. Research consistently shows that a significant portion of the population lacks basic financial literacy skills. Without a solid foundation in financial knowledge, individuals may struggle with managing debt, making informed investment decisions, or planning for retirement. The consequences of financial illiteracy extend beyond individuals, and without a solid understanding of financial concepts and strategies, new organizations can struggle to make informed decisions about saving, investing, and managing their money effectively.

→ Download eBook Now: eLearning Champion

What are the Benefits of eLearning for Financial Education?

1. Enhanced Flexibility and Accessibility

eLearning platforms provide learners with the flexibility to access financial education materials at their convenience. Whether it's through web-based modules or mobile applications, individuals can engage in self-paced learning, fitting their financial education around their existing commitments. eLearning platforms also offer the advantage of self-paced learning, allowing individuals to set their own speed and progress through the material according to their learning preferences. Learners can revisit and review content as needed, reinforcing their understanding of financial concepts and strategies.

2. Interactive Learning Experience

eLearning modules often integrate multimedia elements such as videos, animations, and interactive infographics. These dynamic resources engage learners visually and audibly, making complex financial concepts more accessible and engaging. eLearning platforms often incorporate interactive quizzes, simulations, and case studies to reinforce learning. These activities provide learners with opportunities to apply financial knowledge to practical scenarios, enhancing their understanding and problem-solving abilities.

3. Personalized Learning

eLearning platforms leverage technology to personalize the learning experience. Through user assessments or profiling, platforms can identify learners' knowledge gaps and deliver targeted content, ensuring that learners receive the most relevant and impactful financial education materials. Adaptive learning technologies are designed to dynamically adjust the learning path based on the learner's progress and performance. These technologies offer personalized recommendations, adaptive quizzes, and targeted feedback, enabling learners to focus on areas that require more attention.

4. Organized Tracking and Reporting

eLearning platforms offer comprehensive learning analytics, tracking and reporting features that enable learners and instructors to monitor progress in real-time. Learners can view their completion rates, quiz scores, and overall progress, while instructors or mentors can provide guidance and support based on the learner's performance. eLearning platforms often incorporate various assessment formats, such as multiple-choice questions, case studies, or interactive simulations, providing learners with opportunities to test their knowledge and receive feedback.

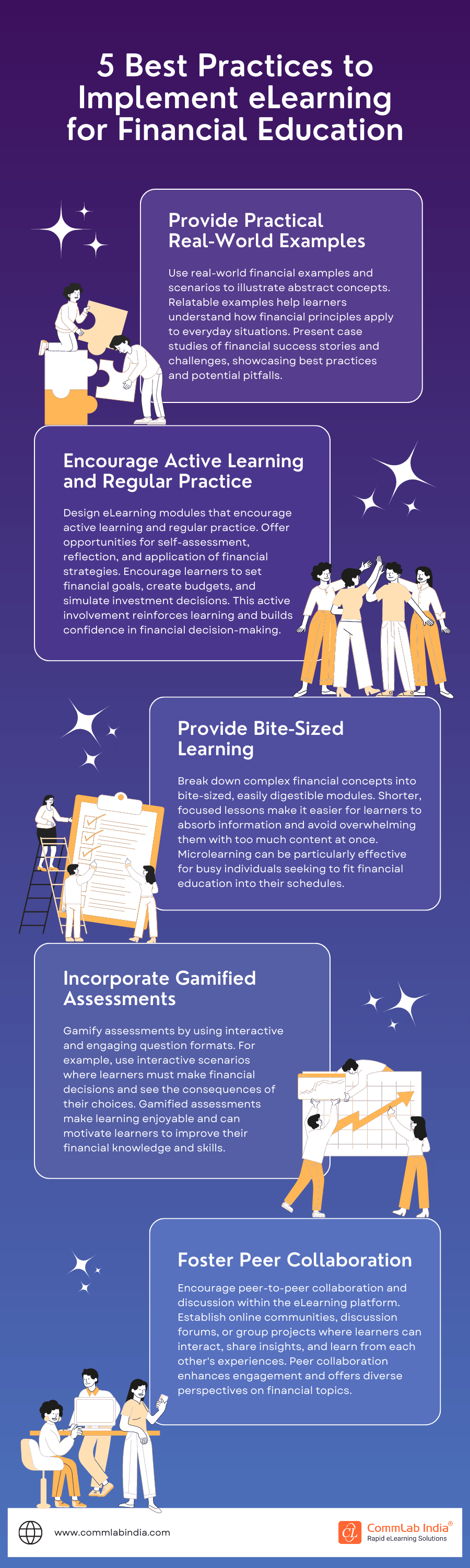

Here is a comprehensive infographic that highlights the best practices to implement eLearning for financial education -

Parting Thoughts!

As the need for financial literacy becomes increasingly evident, leveraging eLearning platforms and resources can play a pivotal role in bridging the financial education gap. By embracing eLearning, individuals can empower themselves with the knowledge needed to make informed financial decisions and improve their financial well-being. Here is an interesting eBook to get started with eLearning today!

![How to Design Effective eLearning Assessments? [Infographic]](https://blog.commlabindia.com/hubfs/blogs/strategies-design-effective-elearning-assessments-info.jpg)